EBRD Invests Record Amount of EUR 279 Million in Serbia in 1H 2020

Wednesday, 22.07.2020.

Wednesday, 22.07.2020.

14:44

14:44

That is more than double of what it invested in the first half of 2019, when the Bank's investments amounted to EUR 130 million, the press release says.

The press release specifies that the EBRD scaled up financing for key banks in Serbia to support small and medium-sized enterprises affected by the coronavirus, making loans available via the Serbian subsidiaries of Banca Intesa, Erste Bank, Eurobank, ProCredit Bank and UniCredit Bank.

As said, investments by the EBRD leapt to a record high in the first half of 2020 as the Bank responded rapidly to the needs of emerging economies grappling with the impact of the coronavirus.

Financing rose to just over EUR 5 billion in the first six months of the year, compared with EUR 3.7 billion a year earlier and a previous first half record of EUR 3.9 billion in 2016.

The EBRD reminds that it invests to promote sustainable and inclusive private sector development across 38 emerging economies ranging from Estonia to Egypt and Morocco to Mongolia.

The economic impact of Covid-19 on the EBRD regions has been severe and in its latest forecast in May the Bank warned of “unprecedented uncertainty”.

In March the EBRD unveiled its coronavirus Solidarity Package – a series of measures put in place to meet the regions’ immediate needs while also preparing for robust recovery once the pandemic is over.

A key pillar of the Solidarity Package is a framework providing emergency liquidity and working capital to existing clients.

Demand for the emergency funding has been strong and the new facility accounted for over EUR 1 billion of total EBRD financing in the month of June alone.

In April the EBRD said it would dedicate the entirety of its activities to tackling the Covid-19 pandemic and that it expected to invest some EUR 21 billion through to the end of 2021. Since the outbreak of the virus, the pace of disbursements has been consistently faster than in 2019.

– Donors have stepped up to support the Bank’s Solidarity Package with a record volume of contributions for the first half of the year, providing much-needed grant and concessional co-financing – the EBRD said.

Covid-19 has severely affected trade flows and access to trade finance, so the EBRD has increased support for commerce under its Trade Facilitation Programme.

In the first half of 2020 the Bank financed over 1,000 trade deals with a record turnover of EUR 1.9 billion. It has raised its total exposure limit under the programme by 50% to EUR 3 billion.

In addition to focusing on the immediate response to the coronavirus, the EBRD is working to ensure that recovery from the pandemic will be resilient and sustainable and in line with global climate goals that preserve commitments to a low carbon economy.

In July the EBRD unveiled ambitious proposals to become a majority “green” bank by 2025.

In addition to its financial investments, the EBRD has concentrated on its policy work to help the economies in its regions respond to the impact of the pandemic.

– The fact that Serbia became a full member of the International Grains Council in April was welcomed as a big step forward in stimulating the agricultural potential of the country thanks to a stronger integration in international markets – the EBRD says.

EBRD Evropska banka za obnovu i razvoj

EBRD Evropska banka za obnovu i razvoj

EBRD London

EBRD London

Banca Intesa a.d. Beograd

Banca Intesa a.d. Beograd

Erste Bank a.d. Novi Sad

Erste Bank a.d. Novi Sad

Eurobank Direktna a.d. Beograd

Eurobank Direktna a.d. Beograd

ProCredit Bank a.d. Beograd

ProCredit Bank a.d. Beograd

UniCredit Bank Srbija a.d.

UniCredit Bank Srbija a.d.

Most Important News

11.03.2024. | Healthcare

Are Marketing Experts Reading Our Minds? – eKapija Investigates: What Neuromarketing Is and How Much It Is Used in Serbia

11.03.2024. | Construction, Transport

Tender for Continuation of Construction of Patrijarha Pavla Blvd Stopped – Contractors Demanding Price Higher Than Estimated

11.03.2024. | Construction, Transport

11.03.2024. | Construction, IT, Telecommunications

Auction for 5G Network by End-Year, Minister Announces

11.03.2024. | Construction, IT, Telecommunications

15.04.2024. | Energy, Industry

Vinca Solid Waste Management Center to start producing heating and electrical energy in the next month

15.04.2024. | Energy, Industry

17.01.2024. | Industry, Healthcare

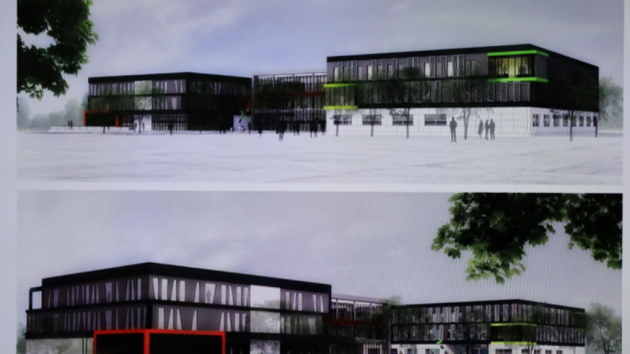

Ceremony of Opening of Centers of Excellence in Kragujevac Planned for Spring – Official Beginning of Operations in June

17.01.2024. | Industry, Healthcare

15.04.2024. | Construction, Transport, Finance

City approves signing of agreement with Ministry of Economy and BAS on continuation of financing of project of new bus station – EUR 20 million over two years

15.04.2024. | Construction, Transport, Finance

Izdanje Srbija

Izdanje Srbija Serbische Ausgabe

Serbische Ausgabe Izdanje BiH

Izdanje BiH Izdanje Crna Gora

Izdanje Crna Gora

News

News