State Measures of Help to Economy Presented – Minimum Wages for Employees at Small Companies, EUR 100 to Citizens of a Legal Age, Tax Payment Postponed

Wednesday, 01.04.2020.

Wednesday, 01.04.2020.

12:00

12:00

The measures pertain to only those who have let go less than 10% of the workers, not counting the hired employees, whose contracts have expired and have not been extended, and to those who have temporarily stopped the activities after March 15.

Of these nine measures, three are tax policy measures, two entail direct help to the private sector and measures for maintaining the liquidity of the economy, and the other measures pertain to the moratorium on dividends until the end of the year and a fiscal stimulation – that is, direct help to all citizens of a legal age.

The first set of measures for the most part entails a postponement of the payment of due tax obligations, with a later repayment in installments, no sooner than from the beginning of 2021:

– Postponement of salary tax and contribution payment aims to secure the liquidity and maintain economic activities and employment.

– Postponement of payment of taxes on salaries and contributions for the private sector, for the duration of the state of emergency, aims to increase the liquidity of all business entities in the economic sector which pay salaries to their employees. Also, this measure pertains to the postponement of payment of taxes on income from self-employment for all entrepreneurs.

– All employers who opt to use this measure can use the postponement of payment of salary tax and contribution costs until the beginning of 2021, after which there's a possibility of further postponement of payment of these costs for up to 24 months, without the obligation of payment of interest at the request of the taxpayer.

The basic conditions for the implementation of this measure are identical for all employers regardless of their economic strength.

– Payment of advance income tax in the second quarter is postponed as well. The measure aims to increase the liquidity of taxpayers by postponing the payment of advance income tax for 2020, which is due in the second quarter of 2020. The basic requirements for the implementation of this measure are identical for all income tax payers, regardless of their economic strength.

– Exemption from VAT payment for all donors. The measure aims to enable exemption from VAT payment for all those donors who donate their products or the products they distribute to the institutions directly involved in the activities which aim to prevent the spreading of the virus and the treatment of citizens for Covid-19.

The second set of measures pertains to direct payments to companies, payment of aid in the amount of the minimum wage for entrepreneurs, micro, small and medium companies and the subsidizing of 50% of the minimum wage amount for large companies whose employees have been sent on a forced leave due to reduced activities or a total suspension of operations.

The measure is expected to start in May.

Direct help to entrepreneurs who are lump-sum tax payers and who pay tax on actual income, micro, small and medium companies in the private sector – payment of help in the amount of minimum wage (during the state of emergency) and to large companies in the amount of 50% of the minimum wage for the employees who no longer work in line with the adopted decision.

When it comes to this set of measures, there's a difference in the manner of implementation based on the economic strength of the tax payer. In line with this, economic help in the amount of the net minimum wage has been provided to entrepreneurs, micro, small and medium legal entities for each person who has the status of an employee.

The third set of measures is directed at preserving the liquidity of business entities in the economic crisis expected after the state of emergency caused by the pandemic ends.

With this program, the Government of Serbia wants to minimize external influences, such as the drop in demand and the breaking of the supply chain and their consequences on the Serbian economy, such as the reduction of employment and non-liquidity.

The program entails two measures:

1. The program of lending aiming to keep the liquidity and working assets for companies in the enterprise segment, micro, small and medium business entities, farms and cooperatives registered in the relevant register through the Development Fund of the Republic of Serbia.

2. Guarantee schemes for supporting the economy in the conditions of the Covid-19 crisis for credits for maintaining the liquidity and working assets for companies from the enterprise segment, micro, small and medium business entities, as well as farms, through commercial banks operating in the Republic of Serbia.

The total value of the programs covered by this measure amounts to RSD 264 billion (around EUR 2.2 billion).

The fourth set of measures pertains to the payment of direct help in the amount of EUR 100 in dinar countervalue to all citizens of legal age in Serbia.

The measures adopted by the Government and already implemented

The prices and margins of vital supplies, protective equipment and retail prices of protective products have been limited, so as to prevent disturbances in the market and enable a regular supply of citizens with vital supplies and protective equipment and devices. For the same reason, the export of basic products (seeds, oil, yeast, soaps, detergents, disinfectants, asepsol, alcohol, protective equipment) has been temporarily banned.

Also, to the end of protecting the populace, a decision was made for all personal documents of the citizens of the Republic of Serbia which have expired to be considered valid during the state of emergency. The deadlines in administrative procedures have been harmonized so that the parties cannot suffer the consequences of not acting within the deadline due to the state of emergency, whereas, in court procedures, the deadlines are no longer valid during the state of emergency, and are to be reinstated after the state of emergency ends.

To the end of protecting the employees and hired persons, a range of measures has been implemented, obliging the employer to enable remote work, work from home, work in smaller shifts, so as to protect employees and hired persons.

Termination of the agreement and collection of unpaid tax debts (from security and in a process of enforced collection), will not apply to tax payers for whom a postponement of payment of tax debts during the state of emergency has been approved, beginning with the installment due in March 2020.

Due to the declaration of the state of emergency in the territory of Serbia, the deadlines for preparation and filing of annual financial reports of direct users of the state budget, the budgets of autonomous provinces and local self-government units, final budget of the Republic of Serbia, autonomous provinces, budgets of local self-government units and mandatory social insurance organizations, as well as the consolidated report of the Republic of Serbia and the consolidated reports of the cities for 2019 are extended.

Temporary measures of the NBS

The National Bank of Serbia has adopted temporary measures to the end of preserving the financial system:

– The moratorium on credit repayment and financial leasing obligations, no shorter than 90 days or from the state of emergency, during which time the bank does not calculate the default interest on due and unsettled liabilities and does not initiate enforcement procedures or procedures of enforced collection, or other legal actions to the end of collecting debts. The debtors do not pay any fees for using this option, and such debts will not be considered restructured, nor problematic.

– For the duration of the state of emergency, leasing providers do not calculate the default interest on due and unsettled obligations and do not initiate enforcement procedures or procedures of enforced collection, or any other legal actions to the end of collecting debts.

– Additionally, under the decision on transaction fees, no fees or other costs can be charged for payments and transactions for the purpose of donations in fighting Covid-19. This decision pertains to banks, e-money institutions, payment institutions and the public post operator, as well as the National Bank of Serbia, for payments and transaction for the purpose of donations in fighting the Covid-19 pandemic.

Cadez: State's set of measures keeps the “backbone” of the economy

Marko Cadez, the president of the Chamber of Commerce of Serbia, said that the state had accepted nearly 90% of the most important measures proposed by companies.

– This set of measures keeps the jobs, maintains the liquidity, the production, keeps the “backbone” of the economy – Cadez pointed out.

Financing of the set of measures

When asked how the package will be financed, that is, whether the state will loan money or it has enough reserves, Mali said that it would be announced soon.

– There's plenty of room and there's money that we will get in the local and the international market, and I'm sure that our public debt will not exceed 60% of the GDP at any point – Mali said.

As he added, now that the state has presented the measures, the structure of the financing of this package will be known soon.

Salaries in the public sector and pensions safe

Mali confirmed that there would be no wage cuts or layoffs in the public sector and that pensions would not be cut either.

– The pensions are safe – Mali said.

Most Important News

11.03.2024. | Healthcare

Are Marketing Experts Reading Our Minds? – eKapija Investigates: What Neuromarketing Is and How Much It Is Used in Serbia

11.03.2024. | Construction, Transport

Tender for Continuation of Construction of Patrijarha Pavla Blvd Stopped – Contractors Demanding Price Higher Than Estimated

11.03.2024. | Construction, Transport

11.03.2024. | Construction, IT, Telecommunications

Auction for 5G Network by End-Year, Minister Announces

11.03.2024. | Construction, IT, Telecommunications

15.04.2024. | Energy, Industry

Vinca Solid Waste Management Center to start producing heating and electrical energy in the next month

15.04.2024. | Energy, Industry

17.01.2024. | Industry, Healthcare

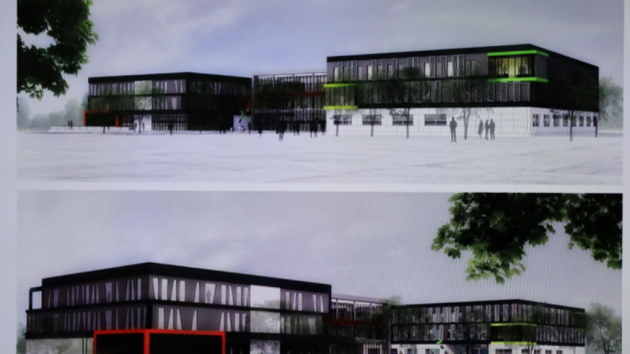

Ceremony of Opening of Centers of Excellence in Kragujevac Planned for Spring – Official Beginning of Operations in June

17.01.2024. | Industry, Healthcare

15.04.2024. | Construction, Transport, Finance

City approves signing of agreement with Ministry of Economy and BAS on continuation of financing of project of new bus station – EUR 20 million over two years

15.04.2024. | Construction, Transport, Finance

Izdanje Srbija

Izdanje Srbija Serbische Ausgabe

Serbische Ausgabe Izdanje BiH

Izdanje BiH Izdanje Crna Gora

Izdanje Crna Gora

News

News